Small Account E-mini Micro’s strategy + October ES Results

Hello Everyone,

As always, I want to update you all on the previous month’s results and we have something NEW for those with smaller trading accounts that want to trade this system. Most of you are aware by now of the Micro eminis (MES) and if you are not, this is a great way for those with smaller trading accounts to have some skin in the game. When I say smaller, I am talking about $400-1000 in your trading account – YES, that is all! Keep reading and I will share our results over the last 6 weeks but first, let’s get into the ES market!

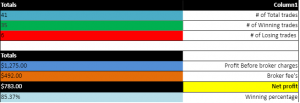

As I stated previously, we are once again focusing on the 1st hour of trading. This concept is what most of you are looking for and these are the results we had (posted) in our live trading room. What we try to accomplish in the live trading room every day is to target 2 winners per day – Only trading the opening hour (9:30 am Est – 10:30 am Est) and walking away. We had about 20 trading days with a couple of FOMC days and a couple of days with no trades in the 1st hour. We ended up with 41 total trades (only 25 in September) and only 6 of those were losers for a win rate of 85%. Remember, I base these results trading ONLY 3 contracts. You can click on the picture to view in a larger size:

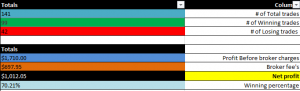

Since I did not update the Final September results on the blog last month (only in an email), you can see them below:

MICRO EMINI’S

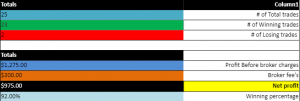

Now that the Micro E-minis (MES) have been trading for a while and daily volume has surpassed the Dow emini, we’ve been keeping an eye on it since we receive multiple emails asking if our scalper system will work equally across that market as well. It took us quite a few hours forward testing numerous chart values to come up with a proper chart, but we finally hit upon a setting using our exact same rules for our existing ETS Scalp system that we can use for the Micro eminis! We had to adjust our chart value and change our target/stop risk reward parameters (1:1 with the micro’s). For example, we are targeting 8 ticks profit with an 8 tick stop loss on the micros The current tick value is only $1.25 as opposed to 12.50 per tick on the ES.

We ran results from September 16th (1st day of Dec contract) through October 30th which is about 6 weeks and had some very nice results. We had a total of 141 trades with 42 losers for a 70% win rate and $1,012 in net profit trading 3 micro contracts! This is very exciting since opening account minimums are as low as $400 with $50 per contract intraday margins per contract! (See your individual broker for their micro specifics.) Check out the breakdown below:

It’s whole new ball game now that people who previously wanted to trade but just had a small or limited amount of capital can now finally participate in the markets! Not to mention those who can now learn and earn in a live market environment while aiming to trade the bigger ES contract…or stay with the micro’s altogether!!

I know I have said this before but If your trading is struggling, or just have limited time and you are looking for a simple system to trade, you owe it to yourself to jump on board now! You can get started for as low as $995 that will include the recorded training webinar (90-minute video), comprehensive manual that you can print out with examples/rules, 6-month software license (this will plot the indicators) and the live trading room. Of course, this will also include the settings we use for the Micro Eminis (MES) market.

I will also be available (on a 1st come 1st served basis & limited) if you need assistance in getting set up and ready to go (ninjatrader, charts, software, data, etc.) You don’t have to get overwhelmed with it all – I am here to help!

Please get in touch with any further questions – have a great weekend!

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.