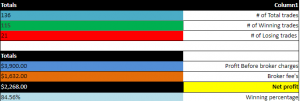

84% Win Rate In February – Jump On Board Today!

Hello Everyone,

You can see below our results using the ETS Scalp system for February. This past month we had a total of 136 trades which is down just a little bit from a normal month. We dealt with a holiday, FOMC day, as well as this past week missing our morning sessions with Chairman Powell speaking all morning on Tuesday & Wednesday. This is all discussed in the Live trading room as far as sitting these times out and of course, avoiding trades during these scheduled events. The live trading room, and I am sure the students will agree, helps immensely!

As you can see in the picture above (Results are based on trading only 3 contracts), we still maintained our impressive winning percentage after all the obstacles we went through. In fact, this week, including this morning, we still managed having our 1st 2 valid trades of the day being winners! Again, as most of you know (myself with many in the Live trading room), we target 2 winners and call it a day – We trade for a daily income! Over the last 2 years, March has been a decent month trading this system and the best part is, its not too late to sign up!

The ETS Scalp system is a method you can learn in about 90 minutes and trade it throughout the day. This setup is VERY exciting because it lacks the subjectivity that trip up some traders – with this technique, there is none! No chops, no reversals, no asking whether to reverse or go flat. This is a much more relaxed way to trade while minimizing the emotional impact some traders are confronted with. It is so simple, that you can trade this exclusively on 1 chart!

Even if you’ve been away from trading for some time or are looking to jump back in, Now is the time!

If you have any other questions, I will be around all weekend

Have a great weekend,

AL

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.