February 22nd, 2017

Hello Everyone,

As mentioned yesterday with FOMC minutes today at 2:00 Est time, its a day I will not trade live. We will resume tomorrow on our schedule.

I wanted to touch on our Breakout Pullback Trade through the end for today. As most of you know I do not post these results everyday on the blog because only a select number of students have this method, however I do keep a log for the trades everyday. I have been receiving emails with the lack of ES trades using our Power trading system on how the Breakout Pullback trade is fairing. My answer is very well 🙂

As many of you know, our newly developed Breakout pullback has produced Excellent results throughout the year and I want to update you on a couple of things.

First, I wanted to share with you one of the messages I received on skype from a long time student in Australia who is now using this Breakout Pullback method:

“Hi Al,

Compliments of the season!

I must say the breakout pullback strategy is quite a piece of work. Well done to you and the ETS team.

I have already began trading it live.

The consistency built into the set ups is truly praiseworthy.

I’ve been around trading for a decade and this is one of the most elegant set ups I’ve seen so far”

I wanted to share this with you for a couple of reasons. First, we appreciate the comments we have received from all of you trading this method and it’s rewarding to us after all the hours we put into this project to hear your postive feedback!. Second, if you’re using other methods and you have not been making consistent money, you owe it to yourself to start with the Breakout Pullback. As mentioned before, this setup is VERY exciting because it lacks the subjectivity that trip up some traders – with this technique, there is none! No chops, no reversals, no asking whether to reverse or go flat. This is a much more relaxed way to trade while minimizing the emotional impact some traders are confronted with. It is so simple, that you will trade this exclusively on 1 chart!

Now is the opportunity to jump on board at the low price of $1,999 if you do not have a ProV3 indicator license at this time. (Contact me for special pricing if you currently hold a ProV3 license.)

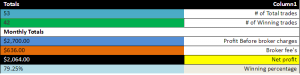

Here are the results below so far through the days end of Feb 21st

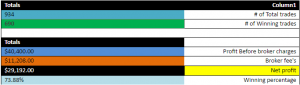

Below, you can take a look at the Year-end results!

Total Results through Jan 4th – December 19th 2016

We skipped the last 2 weeks of December because of the holidays and the extremely low volume. We will resume back up on Jan 3rd 2017!

Additionally, I do have the monthly breakdowns as well, so if you are interested in viewing these, please let me know and I will be happy to send it over. If you’d like to move forward, please click the link below:

Purchase Breakout Pullback Method

Please don’t hesitate to get in touch with any questions as I’ll be around all week.

TUESDAY FEBRUARY 21ST

I hope you all enjoyed your holiday weekend! We were back at it this morning and yet another one with no valid trades. That being said, our Breakout pullback EVEN in this ES market continues to do very well. This System is seperate to our Power trading course and is a Trade you can use throughout the day also as a stand alone system. At the end of today we are at 79.25% win rate for the month so as I am sure you will agree, Excellent result! Tomorrow with FOMC minutes at 2:00 as you all know its a day I stay on sim even with the breakout pullback. I will update the blog tomorrow with additional info on the Breakout pullback if you have interest. See you back here tomorrow!

ES 2-21

No Valid Trades in the morning

1 valid trade in the afternoon which was a winner but didn’t personally get filled

0.00 – Trading the ES

NQ 2-21

Didn’t trade

0.00 – Trading the NQ

6E 2-21

+4+6+6 = +100

+4+6+9 = +118.75

+218.75 – Trading the 6E Today

EET Trader 2-21

No trades

0.00 – Using the EET Trader Today

CL 2-21

No Trades

0.00 – Trading the Crude oil Today

THE RISK OF LOSS IN TRADING COMMODITIES CAN BE SUBSTANTIAL, YOU SHOULD THEREFORE CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION.

CFTC Required Disclaimer: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

FRIDAY FEBRUARY 17TH

Well another day with no valid ES trades during our time slot. The ES has been funny but we will be back next week to see what we can come up with

ES 2-17

No Valid Trades

0.00 – Trading the ES

NQ 2-17

Didn’t trade

0.00 – Trading the NQ

6E 2-17

+4+6+7 = +106.25

+4+6+10 = +125

+231.25 – Trading the 6E Today

EET Trader 2-17

-4-5-5 = (187.50)

-4-4-4 = (150.00)

(337.50) – Using the EET Trader Today

CL 2-17

No Trades

0.00 – Trading the Crude oil Today

THURSDAY FEBRUARY 16TH

ES 2-16

No Valid trades

0.00 – Trading the ES

NQ 2-16

Didn’t trade

0.00 – Trading the NQ

6E 2-16

-6-6-6 = (112.50)

-6-6-6 = (112.50)

(225.00) – Trading the 6E Today

EET Trader 2-16

-4-5-5 = (187.50)

(187.50) – Using the EET Trader Today

CL 2-16

No Trades

0.00 – Trading the Crude oil Today

THE RISK OF LOSS IN TRADING COMMODITIES CAN BE SUBSTANTIAL, YOU SHOULD THEREFORE CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION.

CFTC Required Disclaimer: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

TUESDAY FEBRUARY 14TH

Had one trade this morning and unfortunately it was a loser. I did not make it back to trade the afternoon session so will have to carry over my loss. I will not be around tomorrow so I will not record the trading results. I will be back in the trading room on Thursday so we will see you then.

ES 2-14

-6-6-6 = (225)

(225.00) – Trading the ES

NQ 2-14

Didn’t trade

0.00 – Trading the NQ

6E 2-14

+4 be be = +25

+4 be be = +25

+50.00 – Trading the 6E Today

EET Trader 2-14

No Trades

0.00 – Using the EET Trader Today

CL 2-14

Rollover –

0.00 – Trading the Crude oil Today

MONDAY FEBRUARY 13TH

ES 2-13

+4+4+4 = +150

+150.00 – Trading the ES

NQ 2-13

Didn’t trade

0.00 – Trading the NQ

6E 2-13

No trades based on time

0.00 – Trading the 6E Today

EET Trader 2-13

+4+1+1 = +75

+75.00 – Using the EET Trader Today

CL 2-13

-2-2 = (40)

(40.00) – Trading the Crude oil Today

FRIDAY FEBRUARY 10TH

Finally caught a nice winner and early in the day to wrap it up and enjoy the weekend. We will see you on Monday!

ES 2-10

+4+4+4 = +150

+150.00 – Trading the ES

NQ 2-10

Didn’t trade

0.00 – Trading the NQ

6E 2-10

+4+6+16 = +162.50

No 2nd trade based on time

+162.50 – Trading the 6E Today

EET Trader 2-10

No Trades

0.00 – Using the EET Trader Today

CL 2-10

No Trades

0.00 – Trading the Crude oil Today

THURSDAY FEBRUARY 9TH

We may be going the whole week without a valid trade using the PTS system on the ES. Fortunately those trading the Breakout pullback have had trades and doing well.

ES 2-9

No Valid trades

0.00 – Trading the ES

NQ 2-9

Didn’t trade

0.00 – Trading the NQ

6E 2-9

Didn’t trade this morning

0.00 – Trading the 6E Today

EET Trader 2-9

+3+3+3 = +175

+175.00 – Using the EET Trader Today

CL 2-9

No Trades

0.00 – Trading the Crude oil Today

WEDNESDAY FEBRUARY 8TH

Another day with no valid trades on the ES. We will hopefully catch something tomorrow!

ES 2-8

No Valid trades

0.00 – Trading the ES

NQ 2-8

Didn’t trade

0.00 – Trading the NQ

6E 2-8

+4 be be = +25.00

+4+6+8 = +112.50

+137.50 – Trading the 6E Today

EET Trader 2-8

+4+5+5 = +175

+175.00 – Using the EET Trader Today

CL 2-8

+10+2 = +120

+120.00 – Trading the Crude oil Today